PLTR Stock A Comprehensive Guide to Palantir Technologies’ Investment Potential

Palantir Technologies Inc. (NYSE: PLTR), a leading company in big data analytics, has garnered significant attention from investors and analysts due to its innovative software solutions and data processing capabilities. Founded in 2003, Palantir initially focused on government clients, particularly in the defense and intelligence sectors, before expanding its services to the commercial sector. This comprehensive article will explore PLTR stock, covering the company’s background, financial performance, competitive advantages, growth prospects, and potential risks for investors.

What is Palantir Technologies PLTR Stock?

PLTR Stock Palantir Technologies is a tech firm specializing in data integration, visualization, and analysis. It provides two main software platforms:

- Palantir Gotham – Primarily designed for government agencies, Gotham helps organizations in data-heavy sectors with intelligence gathering, national security, and threat detection.

- Palantir Foundry – Tailored for commercial use, Foundry is used by companies in various industries to manage data, optimize operations, and make data-driven decisions.

The company’s data solutions have proven valuable to sectors from healthcare to financial services. Its unique business model and reputation for handling sensitive data have given Palantir a distinct edge in the competitive tech space.

Key Financial Highlights for PLTR Stock

Palantir’s growth trajectory has shown impressive results since its IPO in 2020. Here are some financial highlights that investors should consider:

- Revenue Growth – Palantir has demonstrated steady revenue growth, with significant year-over-year increases driven by both government and commercial contracts. In recent quarters, Palantir has achieved double-digit revenue growth, reflecting strong demand for its data solutions.

- Profitability – While Palantir has prioritized growth and expansion over profitability in its early years, it has begun to show improvement in profitability metrics. Analysts are closely watching for sustained profitability as a sign of the company’s maturity.

- Cash Flow – Palantir’s focus on high-value, multi-year contracts has generated healthy cash flows, enabling the company to reinvest in R&D and expand its client base. Positive cash flow growth is a promising indicator for potential long-term stability.

- Gross Margin – With high gross margins due to its software-based model, Palantir has the potential to scale profitably. The company’s gross margin has consistently been above 70%, an impressive figure that highlights its operational efficiency.

Competitive Advantages of Palantir

Several factors distinguish Palantir from competitors in the data analytics and artificial intelligence sectors:

- Strong Government Contracts – Palantir has a strong foothold in government sectors, with contracts from major agencies like the Department of Defense, CIA, and FBI. This strong presence in the public sector provides steady revenue streams and high contract renewability.

- Cutting-Edge Technology – Palantir’s software platforms utilize artificial intelligence and machine learning to deliver insights from vast amounts of data. This technology is increasingly valuable in industries with high data-processing needs.

- Proven Security and Privacy Capabilities – Known for handling sensitive data securely, Palantir is trusted by clients dealing with classified or confidential information, which positions it uniquely in regulated industries.

- Expansion into Commercial Markets – While Palantir initially focused on government clients, it has made significant strides in the commercial sector, particularly with its Foundry platform. The expansion into commercial industries provides a significant growth avenue.

Growth Potential for PLTR Stock

- Increased Adoption in Commercial Sectors – Palantir has aggressively expanded into the commercial sector, where there’s considerable demand for data-driven decision-making. Industries such as healthcare, finance, energy, and manufacturing are increasingly leveraging data analytics to improve efficiency and outcomes, a trend that bodes well for Palantir’s Foundry platform.

- Growing Global Presence – With its recent expansions, Palantir has begun to secure contracts in Europe, Asia, and other global markets. International growth could be a significant revenue driver, especially as companies worldwide prioritize digital transformation.

- Product Innovation – Palantir is continuously improving its software offerings, incorporating features like AI-driven data insights and enhanced data visualization tools. Product innovation allows the company to meet evolving customer needs and stay ahead of competitors in a fast-changing tech landscape.

- Strategic Partnerships – Palantir’s partnerships with major corporations, such as IBM, enhance its credibility and market reach. Collaborations with well-known companies allow Palantir to tap into new customer bases and solidify its position as a go-to solution in data analytics.

Risks and Considerations for Investors

While PLTR stock has notable growth potential, there are several risks investors should consider:

- Heavy Reliance on Government Contracts – A significant portion of Palantir’s revenue comes from government clients. Changes in government spending, policy shifts, or budget constraints could negatively impact the company’s revenue and stability.

- Competition – Palantir faces stiff competition from both established tech giants, such as Microsoft and Amazon, and smaller niche players in data analytics. Increased competition could pressure Palantir’s market share and margins.

- Profitability Concerns – Although Palantir is focused on growth, its path to sustained profitability remains uncertain. Investors are closely monitoring its ability to balance expansion with cost management to achieve profitability over the long term.

- Data Privacy and Security Regulations – Palantir operates in a highly regulated industry, particularly in sectors handling sensitive data. Stricter data privacy and security laws could affect Palantir’s operations, particularly if the company needs to adjust its software to comply with evolving regulations.

- Stock Volatility – PLTR has experienced significant price volatility since its IPO, partly due to its high-profile nature and speculative interest. Investors should be prepared for fluctuations in stock price, especially given the company’s growth-oriented strategy.

Recent Developments Impacting PLTR Stock

- AI and Machine Learning Integration – Palantir’s focus on AI capabilities is expected to position the company well as more industries adopt machine learning for data processing. AI integration is likely to drive demand for Palantir’s products, potentially benefiting PLTR stock.

- Expansion of Customer Base – Palantir’s expanding list of high-profile commercial clients is helping to diversify its revenue base. This is a crucial development as it reduces reliance on government contracts and boosts revenue stability.

- Focus on Profitability – In recent quarters, Palantir has shown increased focus on achieving sustained profitability, which could positively impact investor sentiment. The company’s cost optimization strategies and contract restructuring efforts are expected to improve its financial metrics.

Analyzing PLTR Stock Performance and Future Outlook

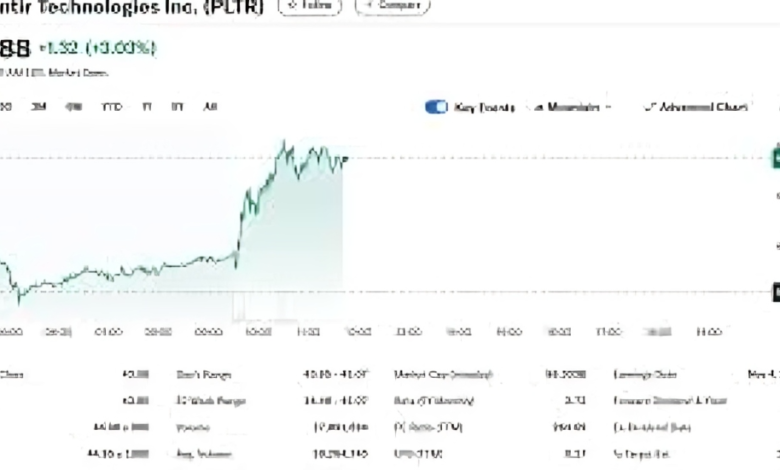

Technical Analysis – From a technical perspective, PLTR stock has shown a mix of bullish and bearish trends. Investors can analyze support and resistance levels, moving averages, and momentum indicators to gauge potential entry or exit points.

Analyst Ratings – Analysts have diverse opinions on PLTR stock, with ratings ranging from “Buy” to “Hold” and “Sell.” The disparity in ratings highlights differing perspectives on Palantir’s growth potential versus its profitability concerns.

Future Projections – The demand for data analytics is only expected to grow, particularly as industries adapt to the digital economy. Palantir’s emphasis on product innovation, expansion into commercial markets, and strategic partnerships could drive its future growth trajectory. However, achieving profitability and navigating regulatory landscapes remain critical challenges.

Should You Invest in PLTR Stock?

PLTR stock represents a unique opportunity for investors interested in the big data and AI sectors. With its strong government presence, expanding commercial foothold, and commitment to product innovation, Palantir offers a compelling growth story. However, potential investors should weigh this against the risks associated with its reliance on government contracts, intense competition, and path to profitability.

For growth-oriented investors with a high tolerance for risk, PLTR stock could be an attractive addition to their portfolio. On the other hand, conservative investors may want to monitor Palantir’s financials and consider waiting for more consistent profitability before making an investment.

Conclusion

Palantir Technologies has established itself as a key player in the data analytics industry, with a unique focus on both government and commercial clients. As PLTR stock continues to evolve, investors will need to balance the company’s growth potential with the inherent risks. Whether you’re looking for exposure to the tech sector or a long-term growth opportunity, understanding Palantir’s business model, financials, and market dynamics is crucial for making an informed investment decision.

By analyzing the factors discussed in this article, investors can better determine if PLTR stock aligns with their investment strategy and risk tolerance.